These days, there are millions of transactions happening every day between two persons or parties whether it is business transactions or personal or repaying debt, cheques play a vital role when it comes to monetary transactions. Cheques not only facilitate monetary transactions between two parties/ persons but also it ensures the safety, security and minimises the risk of default during business deals.

Therefore, in this article, we will understand the basic definition of cheque and their significant types along with features. You’ll be able to learn the following concepts by the end of this article.

- What are Cheques?

- Elements of cheque

- Types of Cheques

- Features of Cheques

Table of Contents

What are Cheques? Definition:

A cheque is a document holding rights to be paid off a specified amount to the bearer of the cheque on a specified date or between stipulated time period. It is categorised as a negotiable instrument like Bill of exchange and promissory notes.

The cheques are issued by the commercial banks to their account holders whether they are individuals or business entities. An individual or firms can issue a cheque to any party or firm for the purpose of payment on a future specific date and the bearer has to present such cheque in the respective bank to be paid off a mentioned amount. Further, the bank is liable to pay the specified amount to the bearer as directed by the account holder of the presented cheque.

Important Elements of cheques:

- Date of payment

- Beneficiary/ Payee Name

- Amount

- Signature

- MICR Code

Types of Cheque:

There are various types of cheques which are utilised by the issuer according to their requirements and terms of payment. Each type of cheque has its own merits and demerits as per both drawers as well as drawee perspective. Hence, let us discuss each type of cheques along with their features and uses in brief.

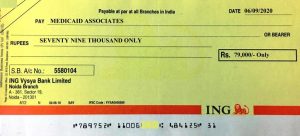

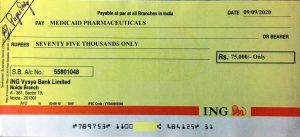

1) Bearer Cheques:

The bearer cheques are those which can be redeemed in cash by anyone who holds the cheque or whose name is mentioned over the cheque. In other words, it is negotiable financial instruments encased by anybody without endorsement who present the cheque in the bank and doesn’t require identification as well and this is because it is risky types of the cheque.

Typically, such cheques are issued by the owner to the most trustworthy and credible person or party. In case of loss of bearer cheques, the issuer can cancel such cheque from the bank to avoid the risk of fraud.

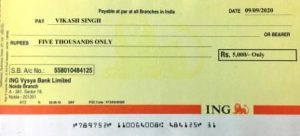

2) Order Cheques:

When the term bearer is strike-off (cancelled) by the issuer, such cheques are converted into order cheque. Order cheques are payable to the specific person whose name is mentioned on the beneficiary column or any other person who is endorsed by the original beneficiary.

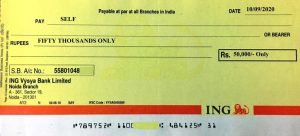

3) Self Cheque:

Whenever the issuer or account holder utilises his own cheque for self-payment or withdrawal of money from his own account, such cheque is known as self cheque. In the case of self cheque, the beneficiary column is filled by the term “SELF” instead of any other person’s name.

Self cheques are usually present by the owner for the purpose of immediate and big withdrawal funds instead of other traditional methods like ATM or slips withdrawal.

4) Account Payee/ Crossed Cheques:

When the issued cheque is crossed twice with two parallel lines at the top corner of the cheque, then such cheque is converted into account payee cheques. An account payee cheque is only payable into the bank account of the beneficiary. Such cheques are considered the safest types of cheques and are used mostly during business transactions by traders to pay the salaries of employees, due invoices and other expenses.

Such cheques are also called a crossed cheque, however, there are basically three conditions of crossings as follows.

- Whenever the cheque is simply crossed by two parallel lines at the top corner, such crossing can be termed as a general crossing. Such crossing indicates that payment should be credited in a bank account only whether in payee or anyone else account endorsed by the original beneficiary.

- If a cheque is crossed at the top corner by two parallel lines and at the same time the term “Account Payee Only” is also written between such parallel lines, such crossing is known as A/c payee crossing which ensures the remittance of payment in the payee bank account only.

- If the drawer wishes to pay a certain amount in any specific bank only, he can simply mention the name of the bank between two parallel lines over the body of cheque which ensures that the payment will be done in the bank account of mentioned banks only. Such a crossing is known as a special crossing.

5) Bankers Cheque:

The banker’s cheque is issued either by the bank itself or on the behalf of its customers for the purpose of clearing various outstanding or payments like rent payment, electricity charges, maturity payments etc. In other words, the drawer of the banker cheque is the bank itself or any other person or entities and the payee could be anybody like the person, firms, company etc.

The payment of such cheques is guaranteed by the bank as unlike other types of cheques, there is no need to deposit money to the issuer’s account. The banker cheques cannot be transferred to anyone ie. it is non-negotiable.

6) Travellers Cheque:

A traveller’s cheque is nothing but a cheque which is used by the individuals during travelling abroad and don’t want to carry a huge amount (cash) with themselves to avoid the risk of theft.

Such cheques can be encased or used for the payment purposes abroad by the owner where the foreign currencies are exchanged/ accepted.

7) Cancelled Cheque:

A common cheque becomes a cancel cheque when it is fully crossed by the account holder (issuer). The cancelled cheques are used for the purpose of validation of certain banking information of firms or individuals.

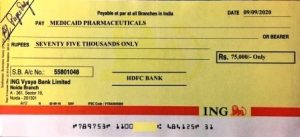

8) Post-dated Cheques:

If a cheque is drawn by the drawer to pay a specific amount to any person/ firm on a future specified date, in this case, a post-dated cheque is issued. A post-dated cheque ensures the payment on a future specified date only, this means it cannot be encashed before the mentioned date.

Such cheques are utilised in businesses where the goods/ services are sold on a credit basis, repayment of the debt, rent payments etc. A post-dated cheque is also used as security during the delivery of goods from one party to another.

9) Blank Cheque:

A blank cheque is typically used during a business deal where a person or firm signs a deal with the company for dealerships/ invoices or any other services or whenever the amount of funds and date of payment is not sure.

A blank cheque neither contains the date of payment nor the sum of money which are generally filled by the beneficiary itself after a mutual discussion on a future specified date. However, it is risky to issue a blank cheque, the issuer generally mentions a maximum limit over such cheque to minimise risk.

10) Gift Cheques:

These are special types of cheque which are designed for gift purposes such as prize money or presents in tournaments or any special events. The design of such cheques is big in size, unlike common cheques. Such cheques are commonly seen during cricket, football, tennis tournament for a man of the match or tournament awards. Such cheques can be obtained from banks upon special requests for an extra fee.

11) Stale Cheque:

The validity of any cheque is 3 months from the date mentioned on the cheque. If the payee would present the cheque after 3 months, the payment will not be done because it is expired. Such cheques are known as Stale cheques.

12) Mutilated Cheques:

The mutilated cheques are those which are damaged or crushed especially the MICR code due to any reasons. Hence a mutilated cheque can’t be encashed due to authenticity of the cheque.

Conclusion:

The different types of cheques have their own features and they are utilised according to the purpose of issuers as well as payees. The cheques are significant financial instruments which ensure risk-free, convenient and flexible delivery of payment for business entities and individuals in the modern era. Hope the above guide will help you to understand the importance and purpose of cheques.

Related Article:

What are the different types of bank deposits?

How to lodge a complaint in the Banking Ombudsman?

Major functions of Commercial Banks

References: Byjus.com [types of cheques] (source)