Table of Contents

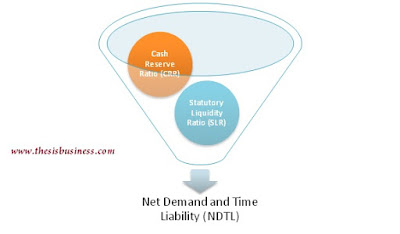

Statutory Liquidity Ratio (SLR):

“The Statutory Liquidity Ratio (SLR) refers to the certain proportion of NDTL (Net Demand and Time Liability) of the commercial banks that has to be maintained with itself in form of liquid assets such as cash, gold or government approved securities by the commercial banks.”

The Reserve Bank of India (RBI), the monetary authority of India, has made compulsory for each commercial bank to maintain the Statutory Liquidity Ratio with itself on day to day basis as per Section 24 of Banking Regulation Act 1949.

The SLR is an important instrument of monetary policy of RBI to control the flow of money in the market. The current value of SLR is 20% however it can be increased up to 40% by the RBI but there no minimum limit, this means it could be 0% as well.

In case of any commercial bank defaults in maintaining the Statutory Liquidity Ratio (SLR) a penalty of 3% over the bank rate is paid and if the commercial banks fail to maintain the SLR on next working day, the penalty of 5% above the bank rate is to be paid.

Components of Statutory Liquidity Ratio:

There are basically three components of the Statutory Liquidity Ratio.

1) NDTL (Net Demand and Time Liability):

The Net Demand and Time Liability refers to the total of demand deposits and term deposits of a bank excluding banker cheques, subsidies and other bank’s deposits.

Demand deposits mean, the cash deposits of a commercial bank from its customers which has to be repaid any time on demand such as saving account and current account deposits.

Whereas, Term deposits are those deposits which have to be paid after a certain period of time (maturity date), for example, fixed deposits, recurring deposit etc.

2)Liquid Assets:

Those assets which can be converted any time into ready cash. The precious metals (gold), government bonds, treasury bills are some examples of liquid assets.

3) Statutory liquidity ratio Limits:

As I explained above the maximum limit of statutory liquidity ratio (SLR) is 40% of NDTL, on the other hand there in the minimum limit of SLR.

Objectives of the Statutory Liquidity Ratio (SLR):

- The Statutory Liquidity Ratio (SLR) ensures the solvency of commercial banks in case of economic recession.

- It facilitates the RBI to regulate the flow of funds in the market.

- It also facilitates the RBI to control the rate of inflation in India.

- The SLR encourages commercial banks to invest their funds into government securities.

- It restricts the commercial banks to prevent its liquid cash from excess liquidation.

- Statutory Liquidity Ratio also plays a significant role if banks are failing to maintain CRR. In this case, banks can sell their reserves (gold, government securities) to maintain CRR.

How SLR control inflation and flow of funds?

There can be two scenarios which are explained below.

Case 1: Suppose RBI needs to reduce the inflation rate.

Step 1: RBI will increase the SLR and hence the amount available with banks to sensation the loans will obviously decrease.

Step 2: The banks will limit the disbursement of different types of loans.

Step 3: Thus the supply of money in the market will also decline.

Step 4: This leads to less demand for goods or services.

Step 5: Therefore, the inflation rate will decline.

Case 2: Now suppose RBI has to enhance the inflation rate.

Step 1: This time RBI will decrease the SLR.

Step 2: Net available funds for loans will increase.

Step 3: Obviously, banks will increase the distribution of various loans.

Step 4: Thus the supply of money will increase in the market.

Step 5: The demand for goods or services will also increase.

Step 6: Ultimately, the rate of inflation will also increase.

Statutory Liquidity Rate vs Cash Reserve Ratio (SLR vs CRR):

- SLR has to be reserved with commercial banks itself whereas CRR is maintained with the RBI.

- SLR is maintained in the form of gold, government securities or cash as well on the other hand commercial banks have to maintain the CRR in the form of cash only.

- There is neither upper limit nor lower limit when it comes to CRR limits whereas in case of SLR there exists only upper limit (no lower limit exists).

- Commercial banks earn a profit on the reserved in the liquid assets (SLR) whereas, in the case of CRR, commercial banks don’t earn even interest.

Hope this lesson would have cleared all your doubt regarding the Statutory Liquidity Ratio (SLR). You would have understood how SLR controls the supply of money and inflation rate.

Related Terms: