In today’s market scenario the companies which are either manufacturers or traders or exporters have to provide credits to its customers for selling goods or services. It could be 30, 40, 60 or 90 days which leads to massive investments for the companies. This becomes a major hurdle for small and medium types of industries and in the case of foreign trade, it also becomes risky.

In this case, the factoring services play a crucial role and consequently, to resolve these hurdles these manufacturers or traders generally hire an agent which receives the payment from its customers (debtors) on company behalf, obviously, the agent will charge some fees for the collection of the payment.

Now let us understand what is meant by Factoring.

What is Factoring?

The ‘Factoring’ is an agreement between manufacturers or traders or exporters (supplier of goods or services) and financial institutions that discount bills of exchange and accountable for receivable (outstanding amounts) from its debtors.

These financial institutions are known as ‘Factors’ and the process of delegating the responsibility for collecting outstanding to the separate entities is known as Factoring.

Factors also advance funds to the companies at the agreed rate of interest or fees, although it maintains a margin or reserve while financing the firms. Generally in Factoring agreement, a factor might charge its commission or interest upfront payable by the supplier.

In other words, Factoring is such type of financial services that advance invoice loans to the seller and collect outstanding from the debtors itself.

Types of Factoring:

There are basically two types of Factoring services available.

- Recourse Factoring

- Non-recourse Factoring

Recourse Factoring:

In this type of Factoring the bad debt or unrecoverable payment are afforded by the firm or seller. In other words, the factor may return the invoices which debtors deny to pay or any other circumstances where the recovery seems to be not possible.

Non-recourse Factoring:

The bad debt will be borne by the factor itself under this type of Factoring. Therefore, commission fees or interest rates are higher in non-recourse factoring agreement.

Factoring services may be further categorised on the basis of the location of buyers and sellers.

Domestic Factoring:

When the buyers and sellers both reside in the same country then this type of Factoring services is known as domestic Factoring.

International Factoring:

On the other hand, in the case of Export and import sellers and buyers countries are different therefore this is known as international factoring.

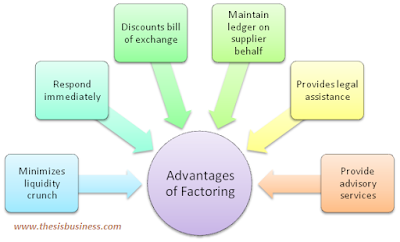

Advantages of Factoring:

Although the Factoring services are offered by the Subsidiary of various banks, yet few banks itself offer the Factoring services. The advantages of factors are as follows.

1) Minimizes Liquidity Crunch:

The factors almost eliminate the liquidity crunch of the exporter or manufacturers (sellers of goods or services) and hence can focus to generate more sales.

2) Responds Immediately:

The factors don’t waste the time of the manufacturers, exporter or traders. They immediately respond within 24 hrs whether to accept the proposal of discounting a bill of exchange or not unlike banks.

3) Discounts bill of exchange:

Factors advance up to 80% of bill of exchange and rest 20% is remitted at the time of final recovery of bills from the debtors. The factors may charge their commission or interest upfront at the time of discounting or at the time of final settlement of bills which depend upon the norms of the Factoring institutions.

4)Maintain Ledger on supplier behalf:

The Factoring institutions also offer services like ledger maintenance on the behalf of sellers-firms.

5) Provide legal assistance:

The factors also provide legal assistance in case of any disputes arises at the time of recovery of bills.

6)Provide advisory services:

The factors provide advisory services related to buyers creditworthiness and other circumstances that helps sellers to take precautions while trading with the clients.

Factoring vs Forfaiting:

Although factoring and Forfaiting services are almost the same yet there are few differences between both. There are some additional advantages of Forfaiting that are described below.

- Forfaiting services are always backed up by a letter of credit or Guarantee since there is the guarantee of both the banks of sellers and buyers. In other words, Forfaitors discount only those bill of exchange which is under the letter of credit or Guarantee.

- Forfaiting services in India are only offered by the EXIM Bank.

- Forfaiting offers the discounting of bills of exchange up to 100% and on the non-recourse basis as well.

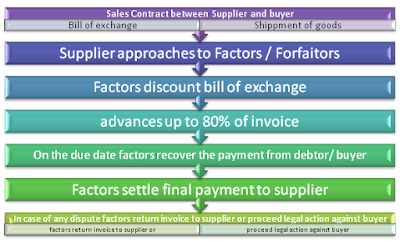

Process of Factoring Service:

Following are the steps involved during Factoring services.

- The sales contract between sellers and buyers is the first step.

- Bill of exchange will be prepared and goods will be shipped.

- Before due date sellers approach to factors or Forfaitors

- Factors/ Forfaitor discount bill of exchange after deducting their upfront charges.

- On the due date, factors recover the invoice from the buyer and finally remit the remaining amount of sellers.

- If any dispute arises during the recovery of payment, factors further proceed legal action or return the invoice to the seller depending upon the services (recourse or non-recourse factoring) offered by factors.

Conclusion:

Hope you would have understood the significance of Factoring services in international trade. We have also gone through some important features of Forfaiting. Thus these financial institutions encourage exports of goods and services of a country and consequently contribute to the economic development of the country.

You might also interested in