The financial system plays a significant role in the economic development of a country especially in the case of developing countries like India. The financial system of India facilitates the mobilisation of funds for the economic growth and development of the country and its residents.

The Indian financial system establishes the bridge between people having surplus funds and people with deficit funds so that the funds available could be better utilised by the individuals or businesses or corporations who know how to multiply it.

In this article, let us understand the whole structure, key components, definition, functions and features of the Indian financial system. We will be covering the following topics in this lesson.

- Financial System of India and

- How Financial System works?

- Structure of the Indian Financial System

- Components of financial system

- Financial Institutions

- Financial Markets

- Financial Instruments

- Financial Services

- Financial Regulators

- Functions of Financial System

Table of Contents

What is the Financial System?

The economic system of a country consists of two segments, people with surplus funds and people with deficit funds. The individuals with deficit money will have to arrange money and people with surplus money willing to invest so that they can yield returns on it.

Therefore, the financial system provides links between lenders and borrowers that let the money flow from surplus funds to deficit funds.

Definition of Financial System –

“The Financial System is defined as the composition of different financial institutions, Markets, regulators, transactions, analytic agencies and fund managers.”

Thus the financial system develops a common platform for borrowers as well as investors so that investors may invest their money and borrowers may arrange funds.

Now let us consider the financial system of India we can categorise the Indian Financial System in two sections.

- Informal Section: Moneylenders, local bankers, traders and landlords basically come under the informal section.

- Formal Section: Now let us explore the formal section of the Indian Financial System that consists of the following 5 components which are also known as elements of financial systems.

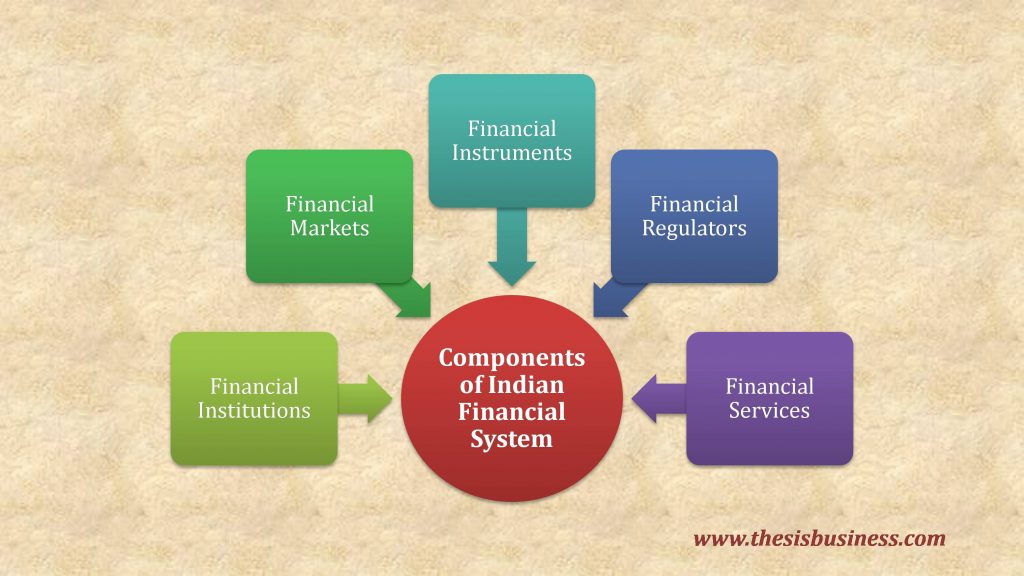

Components of Indian Financial System –

There are basically five components of the Indian financial system.

- Financial Institutions

- Banking Institutions

- Non-Banking Institutions

- Financial Markets

- Money Market

- Capital Market

- Forex Market

- Commodity Market

- Financial Instruments

- Money Market Instruments

- Capital Market Instruments

- Derivative Instruments

- Financial Services

- General Banking Services

- Insurance Services

- Investment Services

- Foreign Exchange Services

- Financial Regulators

1) Financial Institutions –

The first component of the financial system is financial institutions. Financial institutions are private or government entities that offer several services to the general public and businesses for the management of funds.

The financial institutions work as an intermediary between depositors/ investors (who have surplus funds) and borrowers (who require funds). Thus financial institutions fulfil the gap between lenders and borrowers.

For instance, commercial banks, cooperative banks, insurance companies, stockbrokers, mutual funds companies are some examples of financial institutions.

Financial institutions can be of two types.

Banking Institutions –

The banking institutions are those which accept deposits as well as distribute loans to individuals and businesses.

Non-Banking Institutions –

Non-banking institutions don’t accept deposits (cash) from the public but offer various financial products and services to their customers. Insurance companies, mutual funds agencies, stockbrokers and primary dealers are few examples of non-banking institutions.

The Scheduled banks play a major role in the management of money throughout a country at a very foundation level.

2) Financial Market –

The financial market is the marketplace where the actual transactions of financial instruments take place between two persons/ parties. The financial markets can be broadly divided into three categories.

a) Money Market –

It is the marketplace where the short term securities like treasury bills, Repo, commercial papers etc are issued and traded (sold & purchased) over the counter among people.

b) Capital Market –

It is the marketplace where the long term securities like stocks, bonds, debentures are issued and traded. Bombay Stock Exchange (BSE), NSE (National Stock Exchange), NYSE (New York Stock Exchange) are some examples of the capital market. It can be further classified into three categories.

c) Primary Market –

- Secondary market

- Derivative Market

d) Forex Market –

It deals with the exchange of foreign currencies and determines the rate of exchange of currencies as well.

e) Commodity Market –

It basically deals with commodities like gold, silver, crude oils etc.

For more detail check out the link.

3) Financial Instruments –

A financial instrument refers to a monetary document/ contract between two parties that are traded in the financial markets (Money market, capital market or derivative market). It represents an asset of one party and at the same time, the liability of another party.

The financial instruments can be classified as follows:

a) Money Market Instruments –

The money market instruments are the short term debt financing instrument to enhance the liquidity of businesses typically traded over the counter.

- Certificate of Deposit : It is the dematerialised form of funds lent to the corporations for stipulated time period against interest earring. The operating procedures are the same as fixed deposits (FDs) provided any special negotiation.

- Commercial Papers : It is unsecured short term debt instruments usually having maturity period (7days to 1year) typically issued by large cap companies for the purpose of fundraising.

- Treasury Bills : It also short term debt instruments issued by the central Government of India only having maturity period upto 1year.

- Repurchase Agreement (Repo) : The commercial banks and other financial institutions borrow funds from the Reserve Bank of India for a shorter time (Overnight) through Repurchase Agreement by selling government approved securities with a promise to repurchase in future date.

- Call Money : Whenever a loan is granted for one day and has to be repaid the next day, it is known as call money.

- Commercial Bills : The commercial Bills are also traded in the money market and utilised to raise funds against receivables (Due payments). Such practice of raising funds at a discount is called bill/ invoice discounting.

- Banker’s Acceptance : It is another money market instrument which are widely used in the financial market. A banker’s acceptance refers to the extension of loan to the stipulated banks against a signed guarantee of repayment in future.

b) Capital Market Instruments –

The capital market instrument refers to the long term capital financing instrument (debt and equity) traded on the recognised stock exchanges. The corporations issue such financial instruments to raise long term funds from the general public.

- Equity Shares

- Preference Shares

- Debentures

- Corporate Bonds

c) Derivative Instruments –

The derivatives are those financial instruments that don’t have their own value; instead, their values is derived from underlying assets. It is utilised to hedge the risk associated with price fluctuations of the securities.

- Forward

- Futures

- Options

- Swaps

- Exchange traded Funds

4) Financial Services –

The services offered by the financial institutions for the management, lending, borrowing and investment of funds are called financial services.

There are basically four categories of financial services offered in India.

a) General Banking Services –

The services offered by the commercial banks or other banking institutions such as deposit of money, granting loans/ advances, Bill discounting, credit/ debit card, account opening etc.

b) Insurance Services –

The various insurance policies like life insurance, health insurance, car insurance etc are sold under these kinds of services.

c) Investment Services –

The various financial institutions such as stockbrokers, merchant and investment bankers, primary dealers provide investment and asset management services to businesses and corporations.

- Loan syndication

- Underwriting of securities

- Trading of stocks and other securities

- Mergers and acquisitions

- Fundraising services

- Depository services

- Online share trading

- Credit rating services

d) Foreign Exchange Services –

These are the special services that deal in the exchange of foreign currencies.

5) Financial Regulators –

Financial Regulators refers to the government bodies which are responsible for regulating, inspecting, monitoring the functions of various financial institutions like banks, insurance companies, business entities, Non-banking financial companies (NBFCs) etc.

Financial Regulators are the apex bodies of financial institutions of respective sectors which register and function under these financial regulatory institutions. Few examples of financial regulators in India are below.

- RBI (Reserve Bank of India)

- IRDA (Insurance Regulatory and Development Authority)

- SEBI (Securities Exchange Board of India)

- PFRDA (Pension Fund Regulatory and Development Authority)

- FMC ( Forward Market Commission)

Functions of Financial System –

- The financial system fulfils the requirements of funds for business sectors.

- It brings economic growth by allocating the money to those who can better utilise it.

- It leads to capital formation.

- Enables investment by business sectors

- It encourages saving and hence takes back money into circulation.

Conclusion –

Hope you would have understood the importance of the Indian financial system in the economic development of the country. The financial system encourages money into circulation and allocates it to individuals, businesses and corporations.

The financial system of a country is not a solo body but it consists of other institutions as well as corporations and in this way, the whole system functions.

Frequently Asked Questions (FAQ) –

-

What is the financial system?

The financial system is the composition of financial institutions, financial markets, financial securities and services. The financial system of a country facilitates the flow of funds from surplus to deficit so that the available funds can be better utilized for economic growth.

-

What are the functions of the Indian financial system?

The basic functions of the Indian financial system are wealth accumulation and economic growth by

Encourages Savings

Mobilization of Savings

Allocation of funds to those who require -

What are the types of financial systems?

The financial system can be divided into two parts.

Informal Section: Moneylenders, local bankers, landlords & traders

Formal Section: Public & Private Sector Banks or other financial institutions -

What are the objectives of the financial system?

The financial system fills the gap between lenders and borrowers. The main objective of the financial system is to ensure the safety of investment, facilitate capital accumulation and facilitate the economic growth of the country.

-

What are the major components of the financial system?

Financial Institutions

Financial Regulators

Financial Markets

Financial Instruments

Financial Services