Goods or services are bought generally on credit whether it is traded locally or internationally. Therefore, maintaining a positive cash flow becomes a major challenge for suppliers.

Potential Buyers always demand trade credit from sellers while purchasing goods or services. Hence, discounting bill of exchange facilities the suppliers in the management of short-term capital for their business.

This article elaborates what exactly discounting of bill or bill discounting is and how does it work?

Table of Contents

Discounting Bill of Exchange – Definition

A bill discounting or discounting of a bill of exchange refers to the short-term working capital finance extended by the commercial banks or other banking institutions against the invoices/ bills of exchange.

The banks or other financial institutions extend funds to the sellers before its maturity (due date), typically, lower than the invoice value.

In other words, banks purchase the invoice/ bill of exchange from the seller and avail cash (lower than invoice value) to the seller. The difference in value is the bank’s commission/ charge which depends upon the creditworthiness of the buyer and how long the maturity date of the bill is.

Later, on maturity date, commercial banks or institutions itself recover the whole payment from the buyers.

Here, the bill of exchange acts as collateral to avail short-term loans for the seller. The sellers don’t need to provide any additional assets (like inventory, FD, other securities) as collateral to get a loan. Hence, bill discounting/ invoice discounting is the popular way to get short-term credit.

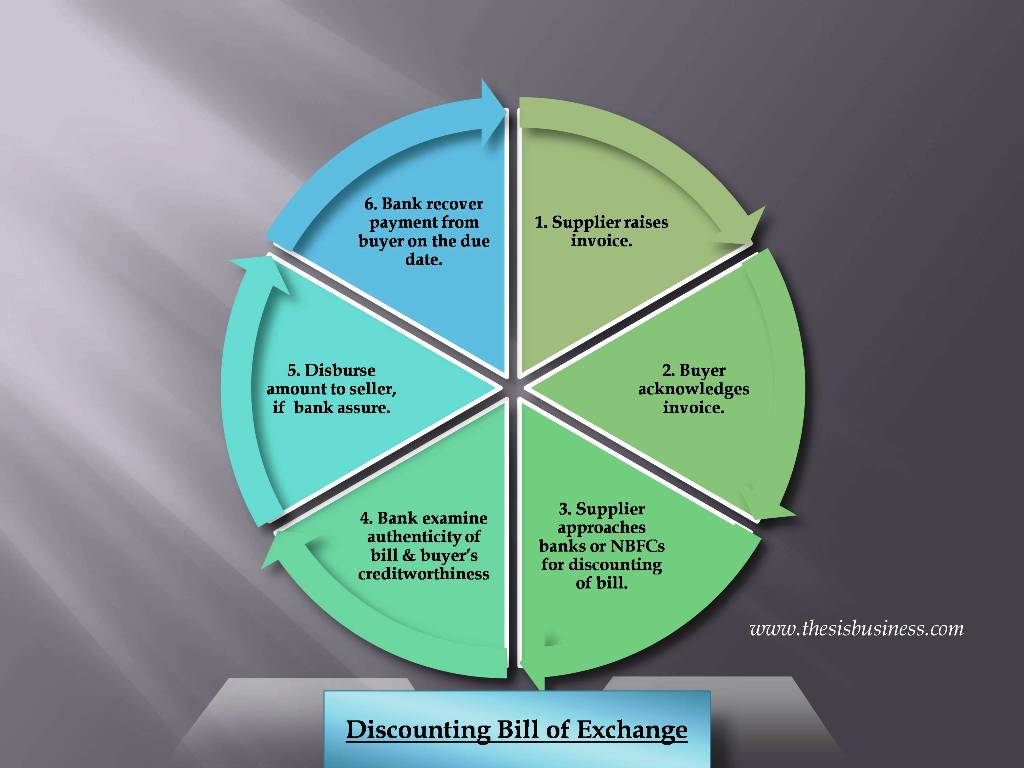

Process of Discounting Bill of Exchange –

There are three parties involved in the process of discounting the bill of exchange supplier viz buyer, and lending institutions like commercial banks. Bill discounting can be of two types.

- For single transaction only – The seller is granted credit for a single invoice only.

- As Renewable Credit – In this variant, the seller grants a renewable credit limit for discounting a number of invoices within 12 months. Eventually, after repayment of subsequent bills by the buyer, the credit limit is reset by the banks.

Steps involved in bill discounting –

- Supplier raises invoice/ trade bill against the purchase of goods or services.

- The buyer acknowledges the invoice raised for the payment on the due date and hence signs the bill.

- Supplier approaches commercial banks or other financial institutions like NBFCs for discounting the trade bill.

- Banks or NBFCs critically examine the authenticity of bills and the creditworthiness of the buyer.

- If the bank or NBFC becomes assured regarding the credibility of the buyer, they disburse the amount to the seller after deducting interest or charges.

- Later on the due date, the Bank shall recover the whole amount from the buyer.

Bill Discounting vs Business Loan –

| Parameter | Bill Discounting | Business Loans |

|---|---|---|

| Purpose | For trading of goods or services domestically/ globally | For capital fund requirements, day to day activities or expansion |

| Collateral | Not required, however, need to pledge invoices. | Required (Not required in case of unsecured business loans) |

| Interest Rate | Depends on the maturity date & risk during repayment. | Depends upon nature, scheme and applicant profile, and financial statement. |

| Eligible companies | Medium and large enterprises with high turnover and financial stability | Startups, MSMEs, Private limited companies, manufacturing companies, shopkeepers, etc |

| Nature of loan | Short-term | Long-term, working capital funds |

| Disbursement | Instant, if approved | 2-4 working days, if approved |

| Tennure | 12 month – 3 years | 12 month – 5 years |

| Loan Amount | Invoice value and nature of business | Depends on a variety of factor but max. up to 1 crore |

Conclusion –

Hope you have understood the concept of discounting bill of exchange. All in all, bill discounting is a type of loan granted by the banks to the seller of goods or services. It caters to short-term requirements of funds for small/ medium sellers. It also mitigates the risk of bad debt and encourages sales.

Recommended Articles –

Business Line of Credit – Explained

Buyer’s Credit – Explained

Supplier Credit – Explained

Trade Credit – Explained

Letter of Credit – Explained