Table of Contents

Debt Fund vs FD:

“Always make investments to create another source of income.” one of the renowned quotes by Mr Warren Buffet, the great investor and entrepreneur.

As we know the rate of inflation varies 5 to 6% in India as per the RBI (Reserve Bank of India) reports if we talk about India. This means the value of Rupee is depreciating at the rate of 5 to 6% over time.

I mean to say that if you have lacs of Rupee in your hand next year its value is going to decrease. Therefore, one should always invest his savings some or the other investment schemes offered by various financial institutions or companies.

However, the major issue is, what should the best mode and types of investment? In India fixed deposits have been conventional, tried and tested form of investment for decades. But some of us don’t aware of various other investment opportunities like Debt Funds.

Debt instruments may be one of the best options available these days but we are still confused regarding the pros and cons of debt funds. That’s why let us conduct a comparison between Debt Funds and FDs.

Though both debt instruments and FDs are the forms of loan or borrowing which the investors give to financial institutions like banks or other financial companies and earn interest against their investment.

Let us first understand what are debt funds and fixed deposits in short.

Debt Funds and Fixed Deposits:

Debt funds refer to funds gathered from people from selling debt instruments such as government bonds, corporate bond, government securities, debentures, commercial papers, treasury bills etc by Government entities, commercial banks, corporations.

Such debt instruments are issued for a short, medium and long term and offer fixed interest rates typically higher than fixed deposits (FDs).

On the other hand, Fixed Deposits are offered by the commercial banks also fixed and guaranteed rate of returns irrespective of current market interest rates over a stipulated time period. Fixed deposits are also flexible in nature, this means one can fix his money for the period of 10 days to 10 years.

Now let us understand what exactly the difference is, between Debt Funds and FDs. To distinguish Debt Funds vs FDs, we need to consider the following 7 grounds of comparison.

Debt Fund vs FD – Which is Best?

The basic motives of any professional investor or general person are not only to earn guaranteed returns with minimum risk but at the same time, some other significant criteria as follows that helps the investors to enhance overall benefits as well as Tax savings from their investment.

- Return on Investment

- Premature Withdrawl

- Taxes Applicability

- Risk Involved

- Dividend Option

1) Rate of Returns:

When comes to returns on investment Fixed deposits offer guaranteed fixed interest rates with high security but lower interest rates as compared to Debt Funds.

On the other hand, debt funds offer a slightly higher rate of interest, however, if we consider the security perspective, it is less secured from FDs even if Debt funds are regulated and supervised under the SEBI (Securities and Exchange Board of India).

The return on investment in case of Debt Funds also depends upon investment horizon, market conditions and type of financial instruments in which you have invested your money. The longer time horizon you invest for, the probability of getting a comparatively higher return will increase.

2) Liquidation (Premature Withdrawals):

The major difference between Debt funds and Fixed deposits is liquidation flexibility. Debt funds are a highly liquid-able instrument. This means you can withdraw your money at any point during maturity period and you won’t be charged any amount for instant withdrawal.

On the other hand, premature withdrawal is not allowed in case of fixed deposits, however, if done so it is chargeable at the rate of 10 to 15% depending on the policies of commercial banks or other financial institutions. Your funds are locked with banks for stipulated time interval and you can’t use your own funds in case of emergency otherwise you’ll have to suffer from the loss.

3) Taxes Applicability:

Taxation is one of the significant aspects of any investment plan. Although both Debt Funds and FDs are taxable at different rates and different criteria.

The banks charge a TDS on net income earned from the interest on fixed deposits and this income is added to your total income as well. Hence, if you are under the top income tax slab of 30%, you are

liable to pay the taxes at the rate of 30% irrespective of whatever time period you have invested your

money for.

On the other hand, in case of debt funds, any TDS typically won’t be deducted. However, taxes are applicable based on time horizon, that means if the time period of investment is less than 36 months, the taxes are applicable same as fixed deposits based on income slabs (for instance 30%).

Whereas, if the time horizon of investment is more than 36 months, the taxes applicable at the rate of 20% because this type of incomes are categorised under the long term capital gains.

4) Risk Involved:

Risks involved are obviously a major concern for anybody whenever we think about investment. As we discussed above fixed deposits are the safest investment avenue than any other available instruments. Hence, when it comes to risk factors FDs must be the preferred choice for anyone.

Whereas, Debt funds are riskier than FDs as the return depends on various economic factors such as future market conditions, investment horizon, diversification of assets, the performance of corporates, inflation, fiscal policies of government etc.

5) Dividend Option:

Dividend option might be available in debt funds, however, in case of fixed deposits, it is not available at all.

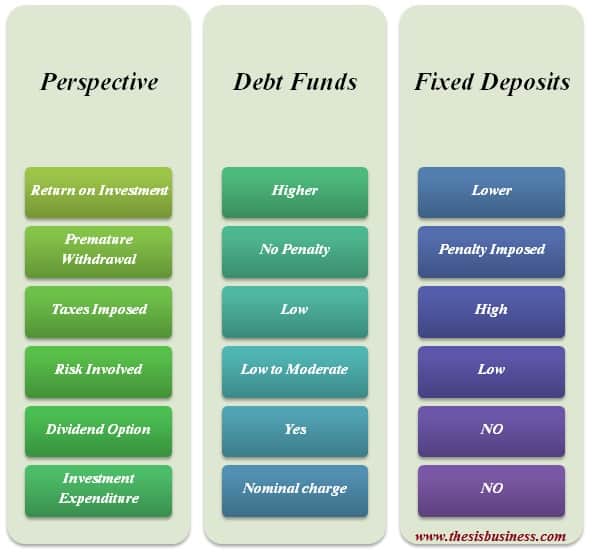

7 Key differences between Debt Funds and FDs:

|

| Debt Funds vs FDs |

In a nutshell, let us distinguish between Debt Funds and Fixed Deposits.

- Debt funds offer higher interest rate comparatively whereas FDs provides lower interest rates.

- Taxes and TDS are liberal on debt funds whereas both are implemented on fixed deposits.

- Liquidation is higher in debt funds than FDs.

- Premature withdrawal doesn’t impose a penalty in case of debt funds, on the other hand, early liquidation imposes a huge penalty in case of FDs.

- Risk factors are more in debt funds than Fds.

- Dividend option may be available for debt funds but it is not applicable on FDs.

- A nominal charge may be applicable as an investment expenditure whereas FDs don’t charge such expenses.

Conclusion:

In a nutshell, there arise two scenarios- The first one is the return on investment and the second is a risk factor. Hence, for whom security is a major concern, fixed deposits can be the best option for them on the other hand, those whose primary intention is to earn much interest, Debt funds may be suitable for them.

Hope this would help you to differentiate between Debt Funds and FDs.

Related Articles: